Written by: Zoey Zhang, Asia Briefing, Dezan Shira & Associates

Entry into the Chinese market is regulated by the country’s negative lists and encouraged catalogue for foreign investment, which stipulate restricted or prohibited sectors and sectors open to foreign investors, respectively.

The 2019 editions of the negative lists and the encouraged catalogue came into effect July 30.

China is committed to ensuring that foreign investors are treated at par with their Chinese counterparts during the entry stage.

However, the government periodically releases negative lists to prohibit or limit foreign investments in key sectors.

China’s upcoming Foreign Investment Law, for example, stipulates, “the state shall implement the management systems of pre-establishment national treatment and negative list for foreign investment.”

Here we explain what these negative lists and investment catalogues are and how foreign businesses can use them to assess the legitimacy of their investment plan in the country.

What should foreign investors pay attention to when planning their China entry?

Foreign players must note that there are specific lists that determine the sector-based investment access of foreign-invested enterprises (FIEs). These are:

1) Negative lists directed at foreign investors; and

2) General negative lists, which are applicable to all enterprises, including domestic enterprises.

Thus, there are at least four “negative lists” that foreign businesses must keep track of.

The negative lists specifically applicable to foreign investors include:

- The Special Administrative Measures on Access to Foreign Investment (2019 edition) (“2019 FI national negative list”) (Full list in Chinese available here); and

- The Free Trade Zone Special Administrative Measures on Access to Foreign Investment (2019 edition) (“2019 FI FTZ negative list”) (Full list in Chinese available here).

The negative lists applicable to all foreign and domestic players include:

- The Negative List for Market Access (2018 edition) (“2018 MA negative list”) (Full list in Chinese available here); and

- The Guidance Catalogue of Industrial Structure Adjustment (2011 edition) (2013 amendment) (“2011 guidance catalogue”) (Full list in Chinese available here).

Besides the negative lists, there is also the “positive list” or “encouraged catalogue”.

Foreign capital is encouraged to enter the sectors listed in The Catalogue of Encouraged Industries for Foreign Investment 2019 (“2019 FI encouraged catalogue”) (Full list in Chinese available here).

What is the FI negative list?

The FI negative list refers to a list of prohibited or restricted industries for foreign investment.

- For prohibited industries, foreign investors are not allowed to set foot in – through investments or partnerships or takeovers.

- For restricted industries, foreign investors must meet the specific conditions, such as shareholding limits, stipulated by the negative list.

- Beyond that, foreign investors might need prior approval from the government to invest in restricted markets.

For industries not on the negative list, foreign investors shall be treated equally as their domestic counterparts – when accessing the industries, save for record-filing requirements.

Currently, there are two FI negative lists that are applicable to different areas in the country – the FI FTZ negative list and the FI national negative list.

FI FTZ negative list

The FI FTZ negative list is applicable to FIEs located in the countries’ pilot free trade zones and is less restrictive than the national one.

The first FTZ negative list was released in 2013 when China’s first pilot FTZ was established in Shanghai. The list is generally revised every year.

Between 2013 and 2019, the prohibited or restricted items in the FTZ negative list were reduced from 190 to 37.

FI national negative list

The FI national negative list is applicable to FIEs in other regions – outside the FTZs.

The first FI national negative list was detached as an independent document in 2018 from the Catalogue of Industries for Foreign Investment (2017 revision) and combined the “prohibited” and “restricted” categories of the 2017 catalogue.

Between 2011 and 2019, the number of prohibited or restricted items have fallen from 180 to 40.

The 2019 editions of both, the FI FTZ negative list and national negative list, took effect on July 30, 2019.

How is the MA negative list different from the FI negative list?

Unlike the FI negative list, which only applies to foreign companies, the MA negative list (negative list for market access) standardizes market entry rules for all players, including state-owned firms, private companies, joint-ownership firms, and foreign firms.

The newest MA negative list was issued in December 2018 and divided industries into two categories – “prohibited” and “restricted” industries.

Of the 151 sectors on the MA negative list, four are completely prohibited and the rest of the 147 sectors are restricted, requiring government approval.

The list also outlines prohibitive regulations as well as required technical standards and qualification criteria to enter restricted market.

Sectors that are omitted from the list are considered “permitted” industries, meaning that entities can enter on an equal footing and theoretically do not need an approval process.

The MA negative list was first piloted in 2016 across several cities, including Shanghai, Tianjin, Fujian, and Guangdong, before being expanded to 11 more provincial regions in 2017. The 2018 MA negative list finally applies to the whole country.

In addition, the MA negative list has two annexes:

- The Annex 1 describes the prohibitive regulations and their legal basis.

- The Annex 2 amends some measures of the “restricted” and “obsolete” sectors categories of the Guidance Catalogue of Industrial Structure Adjustment (2011 guidance catalogue).

Guidance Catalogue of Industrial Structure Adjustment

Similar to the MA negative list, the Guidance Catalogue of Industrial Structure Adjustment applies to all businesses. The catalogue reflects China’s policies on industrial restructuring.

It is an important reference basis for Chinese governments to manage local investment projects and formulate fiscal, tax, credit, land, import, and export policies to various sectors.

The guidance catalogue includes three categories – “encouraged”, “restricted”, and “obsolete” sectors.

Among them, “obsolete” sectors cause huge wastes of resources, serious pollution to the environment, and practices unsafe production.

Local governments are enabled to take measures, such as withholding loans from financial institutions, to eliminate those sectors. Foreign investors should avoid projects falling under this category.

The “restricted” sectors either adopts backward technologies that causes waste and damages to the environment or is not conducive to the optimization and upgrading of industrial structure.

Government policies will curb the development of projects in this category. Foreign investors can should keep an eye on policy changes in these areas.

The most recent guidance catalogue was released in 2011 and amended in 2013. But a 2019 update has been drafted out, waiting to be published (the draft in Chinese is available here).

The Annex 2 of the MA negative list amended some measures of the “restricted” and “obsolete” sectors as contained in the 2011 guidance catalogue; the unchanged measures are, however, still valid.

Foreign investors need to analyze these unchanged measures when choosing to enter sensitive sectors – it is best to eliminate any confusion on the government’s position at the pre-entry stage.

The FI encouraged catalogue

The FI encouraged catalogue is a list of industries where foreign investment is welcome and may be able to enjoy preferential treatment from respective local governments, such as through tax incentives, streamlined approval procedures, and discounted land prices.

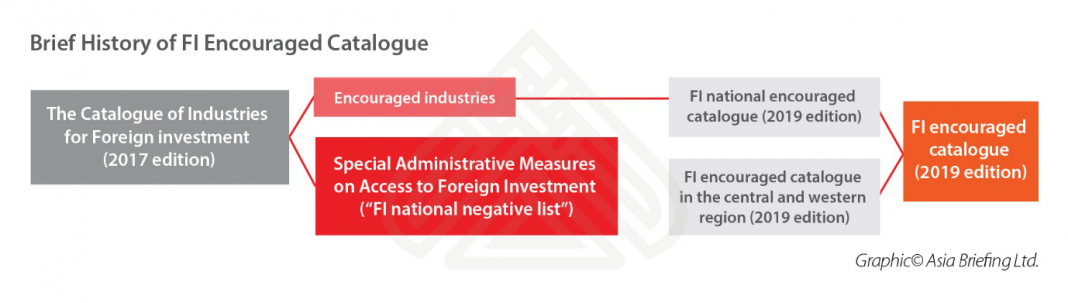

The 2019 FI encouraged catalogue consists of two sub-catalogues – one applies to the whole country and one is applicable to 22 provinces in China’s central, western, and northeastern regions (“FI encouraged catalogue in the central and western region”).

The FI encouraged catalogue for the central and western region was first released in 2000 and the 2019 edition of this regional catalogue is the fifth revision.

The national encouraged catalogue, however, is derived from the “encouraged” category of the Catalogue of Industries for Foreign Investment (2017 revision) and was updated in 2019.

The 2019 FI encouraged catalogue took force on July 30, 2019.

How to use the negative lists and catalogues

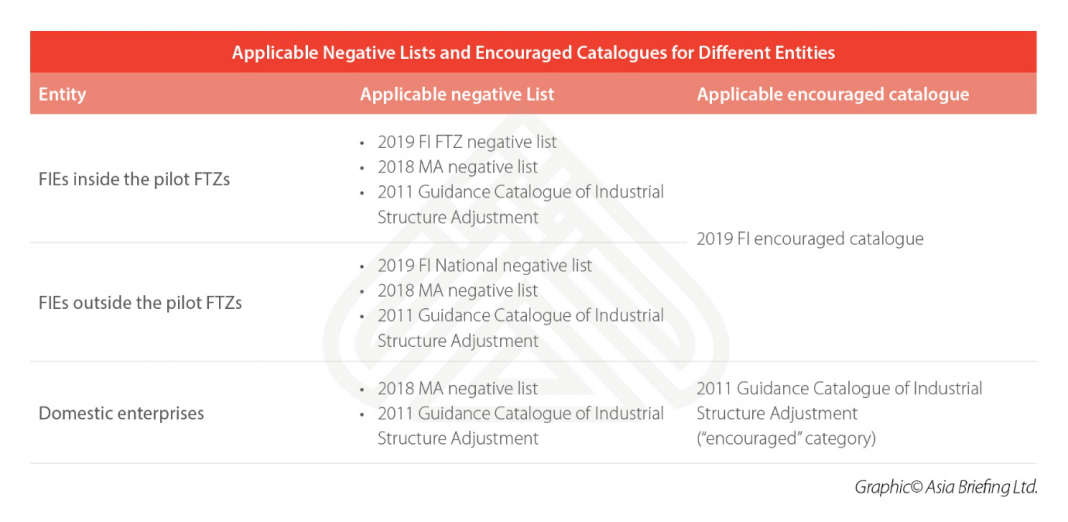

To better understand how businesses should look at the above-mentioned lists and catalogues, we have prepared the following table, which identifies the negative lists and encouraging lists applicable to different entities.

Foreign investors looking to enter the Chinese market may follow this table to find the necessary lists or catalogues.

For example, foreign businesses located in the pilot FTZs should first examine the 2018 FI FTZ negative list to check whether the investment is permitted at all in a sector or through what ownership structure is the investment allowed.

Subsequently, they must check the 2018 MA negative list to see if any further licensing or certification requirements are required.

Finally, they must refer to the 2011 guidance catalogue to see if their specific technology, equipment, and products are blocked in the country.

Seeking local expertise is advised.

This article was first published by China Briefing, which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in in China, Hong Kong, Vietnam, Singapore, India, and Russia. Readers may write info@dezshira.com for more support.