China recently announced that it would lower its value-added tax (VAT) rates and expand the criteria for businesses to qualify as small-scale VAT taxpayers, as part of an RMB 400 billion tax cut package.

In support of this announcement, the State Administration of Taxation (SAT) issued two new circulars explaining the changes to the VAT system: SAT Announcement [2018] No. 17 and SAT Announcement [2018] No. 18.

The announcements explain changes to the VAT system, and offer timelines and guidance for implementation. As the bulk of the changes are set to take effect on May 1, 2018, companies located in or doing business with China should take action to adjust to the tax updates and determine how their operations will be affected.

![]() RELATED: How to Calculate Corporate Income Tax in China

RELATED: How to Calculate Corporate Income Tax in China

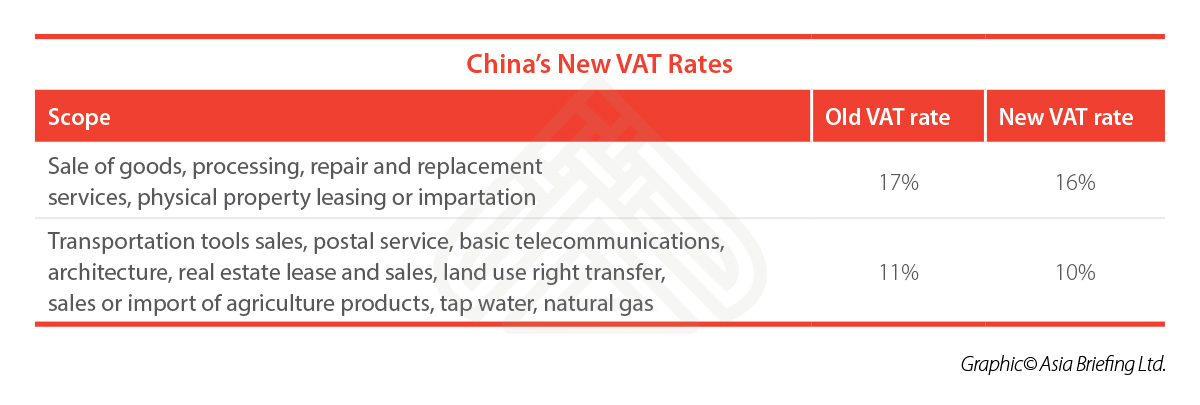

New VAT rates

From May 1, taxpayers originally subject to VAT rates of 17 percent and 11 percent will now be subject to rates of 16 percent and 10 percent, respectively. Taxpayers subject to the six percent VAT rate will see their obligations unchanged.

Also from May 1, export VAT rates and export rebate rates originally subject to 17 percent and 16 percent will be adjusted to 16 percent and 10 percent, respectively.

Also from May 1, export VAT rates and export rebate rates originally subject to 17 percent and 16 percent will be adjusted to 16 percent and 10 percent, respectively.

The MOF and SAT specified a transition period for export sales made before July 31, 2018. Namely:

- For production enterprises: Rebate rates shall not be subject to the VAT rate adjustment.

- For foreign trade enterprises: If VAT has been levied at the original VAT rates when purchased, rebate rates shall not be subject to the adjustment. If VAT has been levied at the adjusted tax rate when purchased, the adjusted export tax rebate rate shall be applicable.

New small-scale VAT taxpayer criteria

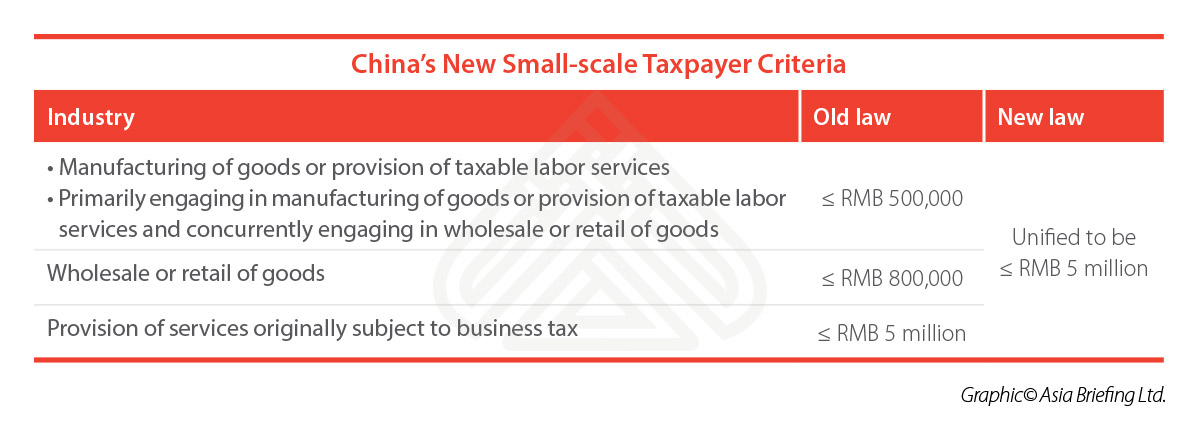

Along with the VAT rate reductions, China will expand the criteria for businesses to qualify as small-scale VAT taxpayers, also from May 1. Small-scale VAT taxpayers benefit from lower VAT obligations, but are generally unable to issue special VAT fapiao.

Previously, there were three separate industry-specific tiers to determine small-scale VAT taxpayer status. With the changes, the three tiers will be unified into a single standard.

Those already registered as general VAT taxpayers have the option to transfer to small-scale VAT taxpayer status until December 31, 2018, if they meet the criteria. The criteria to qualify as a small-scale VAT taxpayer is based on a business’ annual revenue. Namely:

Steps for businesses to take

SAT announcements No. 17 and No. 18 describe the treatment of certain VAT-related activities during the transition period to the new rates.

The announcements clarify that for transactions occurring before May 1, the original tax rate will be applied for general taxpayers that have not yet issued fapiao but must issue one at a later time.

This clarification removes the possibility for businesses to be exposed to tax losses, in cases where goods or services were purchased before the May 1 tax cuts but the invoices issued afterwards, at the lower tax rate.

However, some of the SAT’s explanations remain unclear, and it has not yet issued explanations for the treatment of some other procedures during the transition period.

For instance, the method for determining the relevant VAT rates for the following points lack guidance when some occur before May 1 and others after May 1:

- The time at which the VAT taxable behavior occurred, which usually refers to goods delivery or confirmation on receipt of goods;

- The time at which point the output VAT is recorded in the accounting books; and

- The time at which the VAT special invoice is issued.

The three points above take place at different times, which complicates the determination of which VAT rate to use for transactions occurring during the transition period. If some of the above points begin before May 1 but others occur after, potential tax losses may arise.

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

Accordingly, we recommend that businesses take into account the following practices:

- We advise businesses to contact suppliers regularly. If they are planning to transfer from general taxpayer status to small-scale taxpayer status, it may have an impact on the company’s VAT rebate.

- For exporting, we advise businesses to ensure that the exported goods complete customs clearance and to issue export VAT invoices before July 31, 2018. Failure to do so may result in a tax loss from exposure to a lower rebate rate.

- We advise businesses to renew the tax rate settings of their internal systems, such as the purchase order module and invoice module, to ensure that the new input VAT rates and output VAT rates are included. We also advise businesses to inform key users of such changes and perform regular checks to make sure the rates are applied correctly.

- We advise businesses to avoid placing large orders before the end of April in order to avoid the risks and time commitments associated with multi-period transactions.

- The SAT clarified certain VAT-related issues with announcements No. 17 and No. 18, such as which rates apply for transactions occurring before May 1. However, the announcements are not detailed enough to guide tax staff on how to operate in practice. We therefore advise businesses to keep in touch with the local tax bureau for further guidance, or to enlist the services of professional tax advisors.

This article was first published on China Briefing.

Since its establishment in 1992, Dezan Shira & Associates has been guiding foreign clients through Asia’s complex regulatory environment and assisting them with all aspects of legal, accounting, tax, internal control, HR, payroll, and audit matters. As a full-service consultancy with operational offices across China, Hong Kong, India, and ASEAN, we are your reliable partner for business expansion in this region and beyond.

For inquiries, please email us at info@dezshira.com.

Further information about our firm can be found at: www.dezshira.com.