By: Hugo Butcher Piat, China Briefing, Dezan Shira & Associates

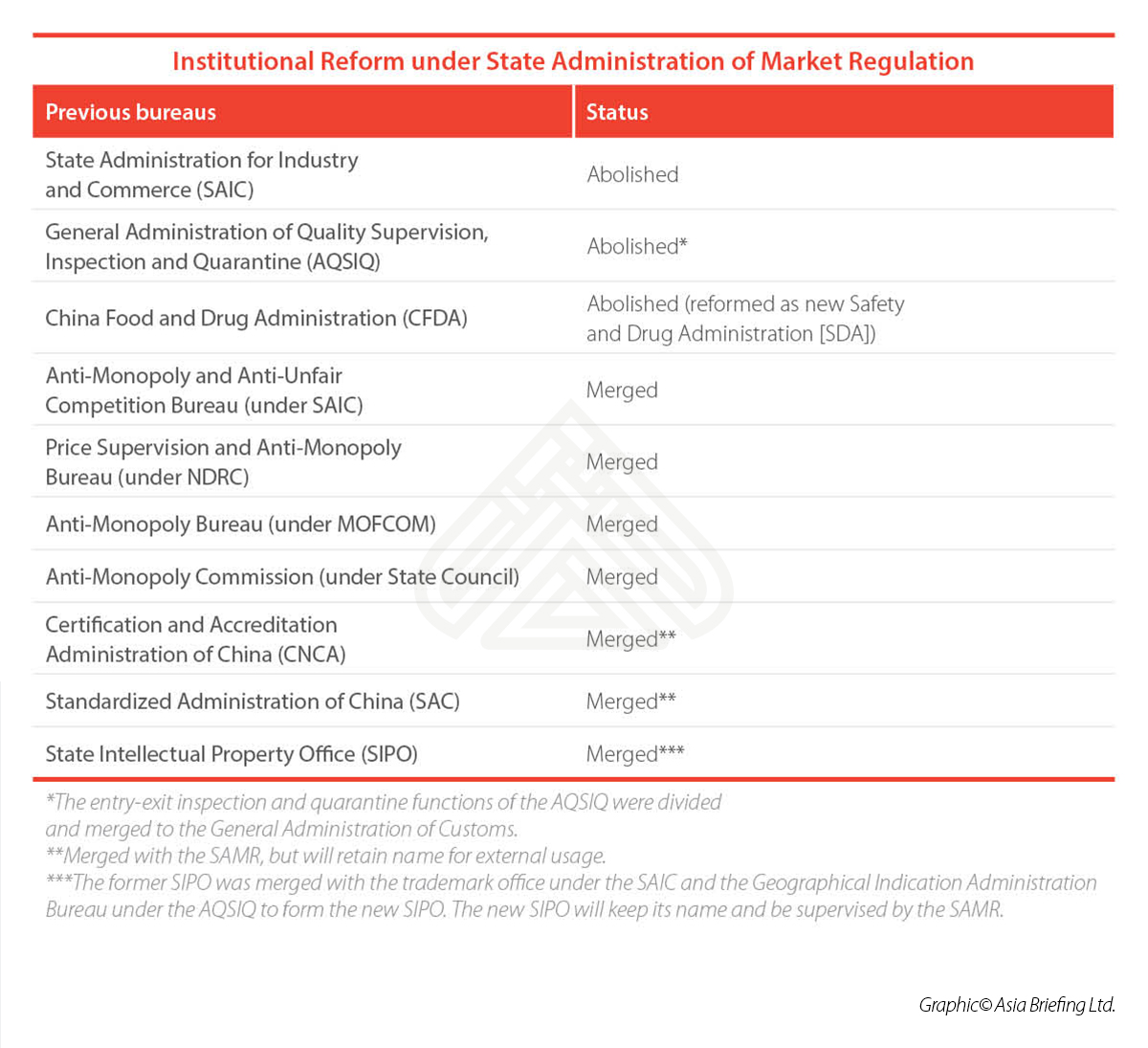

China’s new market regulator, the State Administration for Market Regulation (SAMR), is a result of the reshuffling of several government bodies to eliminate duplication of work, streamline regulation, and improve coordination between ministries.

First announced on March 17, 2018, the National People’s Congress stated that a sweeping overhaul of government administration would be underway, the details of which were finalized on August 9.

The SAMR now subsumes the responsibilities previously held by various regulators and will oversee all manner of market controls – regulating anti-monopoly behavior, intellectual property rights, drug safety supervision, and the issuance of business licenses, among others.

The reshuffle aligns closely to President Xi Jinping’s wider policy goals, which focus on strengthening market supervision and social management to achieve better public service and environmental protection.

Regulatory reform in China

The pre-reform and post reform regulators responsible for market controls are explained below.

The new SAMR bureaus and their areas of function are as follows:

- Office:Responsible for the daily operation of the organization and overview all activity from a macro perspective.

- Comprehensive Planning Division:Research, analyze, and promote market supervision and management and reform. Also, drafting of key documents and compiling market statistics.

- Department of Regulations:Drafting market supervision and management related draft laws and regulations and regulations. Administrative law enforcement supervision. Organize relevant publicity and education work on the legal system.

- Law Enforcement Inspection Bureau:Set system measures for supervision and investigation of market supervision and organize and implement the measures.

- Registration and Registration Bureau(for Small and Medium Enterprises): Implement unified registration system for enterprises and market entities and the issuance of business licenses. The system involves an electronic registration of the entire process. Consequently, the bureau will establish a complete list of small and medium enterprises in the country.

- Credit Supervision and Management Department:Formulate system measures for credit supervision and management. Implementation of the national enterprise credit information publicity system. Publish “blacklists” of non-conforming market entities and manage information and public information sharing systems.

- Anti-monopoly bureau:Set measures and guidelines and undertake anti-monopoly law enforcement.

- Price Supervision and Inspection and Anti-Unfair and Unfair Competition Bureau:Set measures and guidelines on supervision and inspection of price charges and anti-unfair competition. Investigate price violations and unfair competition. Firmly limit direct selling companies, direct sellers and their direct sales activities, and combat pyramid schemes.

Effect on foreign investors

The SAMR will essentially regulate the following functions: drug safety supervision; quality inspection; fair competition and commercial bribery; issuance of business registration; certification and accreditation; management of intellectual property rights; and comprehensive supervision and management of the market order.

This is a very broad overview of all manner of market controls. Meeting the concerns experienced in all these areas is paramount, with special consideration for areas like health, drug and food where constant product failure has caused the public to become skeptical of government management.

The creation of the SAMR should simplify administrative procedures, provide consistent enforcement standards, and lower compliance costs. In short, the centralization through SAMR will ensure better coordination of resources. In theory, this move should benefit China’s markets. In practice, the changes will take time to settle and may require on-going tweaks.

Streamlining Chinese bureaucracy – What to expect from the new transition

Although the reshuffle is aimed at streamlining bureaucracy, disruptions are highly likely as the actual executives in charge of bureau functions will not change in some cases.

In cases where new executives are brought in, an adjustment period is likely to hamper rapid change as they settle in to a new environment.

Further, with the expansive powers of the SAMR, new and present interest groups will lobby to maintain or gain some portion of control over the prevailing system.

Though efforts to stamp out corruption and nepotism are key aims set forth by Xi, it remains a fact that completely removing all social and business connections of individuals will be difficult to manage.

At the same time, having less overlap between regulatory agencies will mean clearer lines of responsibility for regulators and clearer compliance rules for companies to follow.

This had been a major concern in the past. For instance, under the old arrangement, responsibility overlap between the NDRC and SAIC led to unclear rules governing what constituted anti-trust behavior.

Removing such ambiguity will instill accountability for regulators and predictability for companies.

Centralized regulation facilitates greater surveillance

On the technology front, the Chinese government is in the process of rolling out an ubiquitous social credit system to monitor Chinese citizens and companies alike.

The National Enterprise Credit Information Publicity System performs this function for companies. For example, the platform publishes the inspection results of companies. They serve to promote ‘good’ behavior and discourage ‘bad’ behavior by operators.

What defines this behavior is at the discretion of the regulator. Admittedly the system offers random inspections of companies by random inspectors as a means of reducing the chances of ‘personal relationships’ interfering. However, the fact that all data is controlled by a single source is a cause for concern.

The relevance of this example is that centralized data facilitates convenience – from the perspective of the user – in receiving service but can be used as a tool for the government to ‘correct’ market conditions. Whether or not these corrections will benefit or hinder foreign investors in the long-term remains to be seen.

One window, one stop

Information accessibility will rise with a centralized database brought on by the current restructuring.

This means a ‘one-window’ interaction with government bureaus can be established where maintaining relations with just one point of contact replaces the need to contact multiple bureaus and government agencies.

The value here for foreign investors is that less time is required to deal with the bureaucracy elements in China. However, as centralization gives with the one hand, in the form of access to information and convenience, it takes with the other, in the form of compliance and privacy issues. For privacy, the issue is closely linked to the new credit rating system and this is a personal issue and no moralizing is necessary here.

However, the compliance issue arises when hyper-connected systems of data are used. It means that instant changes can be made as opposed to gradual ones. For example, if a new law is passed that requires you to obtain a license or comply with IT privacy rules for staff’s personal information, you have no excuses. You must be on top of the latest changes and failure to do so will be to your detriment, in terms of either fines, penalties or loss of revenue.

Emphasis on IP rights

Zhang Mao (张茅), the director of the SAMR, has indicated that the reshuffle illustrates China’s move to rapidly improve intellectual property (IP) rights protection.

China is looking to step away from labels such as ‘copycat’ products and ‘factory of the world’, making efforts to protect IP rights to nurture innovation and home-grown talent.

Of course, policy change often does not equate to actual change.

China’s enforcement and judicial systems require a vast overhaul and constant bettering before the effects of better IP rights protection can be felt. Such transitions were experienced by all currently developed nations at some stage in their history. China has the benefit of a centralized policy and enforcement agencies to quicken the process.

IP rights enforcement in China is rapidly improving. The legal process from filing to prosecution is not the same in each country, and China tops the list in some regards. For example, with patent prosecutions, China generally leads the EU and USA in terms of turnaround times. In Beijing at least, the average verdict is released with around 100 days. Compare this to the EU, around 18 months, and the US, around 24 months.

It is facts like these which the vast majority of people anywhere in the world do not take into consideration, preferring to reel-off hearsay that China is rampant with IP abuse and there is zero chance of protection under Chinese law.

Though inefficiencies continue to remain in China’s legal system, the overall trend is a strengthening of policy and this SAMR reform indicates the action component to the policy theory.

What this means for foreign investors is to know which IP rights affect your business and to be on top of the relevant trademarks, patents or copyrights. The process for registering each of these functions falls within the range of several months.

Failure to protect your IP can generally lead to every other part of your business being unusable, and in some cases, when other individuals register your IP first, they have legal control of what you currently possess.

As a reminder, if you choose to publish any of our content, please include the following caption at the end of the article:

This article was first published by China Briefing which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.