Amid a global inflationary surge impacting consumer prices, China’s own inflation data has been relatively stable so far. As the country’s supply chain is gradually returning to normal after the lockdowns ended, commodity prices look to benefit. Nonetheless, data shows that China’s economic trajectory is on a slowdown, and more stimulus measures will be needed to attain the country’s goal of a 5.5-percent annual growth.

Global inflation is soaring, exacerbated by the geopolitical tension in Ukraine and reflected in sky-high food and energy prices. The disruption to markets and the global supply chain is causing the largest commodity price uptick in decades. Many countries are reporting decade-high inflation rates: 8.6 percent in the US in May, 8.1 percent in the Eurozone in May, and 9 percent in the UK in April.

Nonetheless, inflationary pressures are easing in China, with data showing that May factory-gate inflation rose at its slowest pace in more than a year, while consumer prices stayed flat. The data was reported a day after better-than-expected trade figures were released by the government pointing to an upswing in the Chinese economy. Additionally, as China’s COVID-19 curbs continue, the public’s modest demand will unlikely lead to a rapid rise in domestic inflation.

China’s inflation data at a glance

CPI remains flat in May

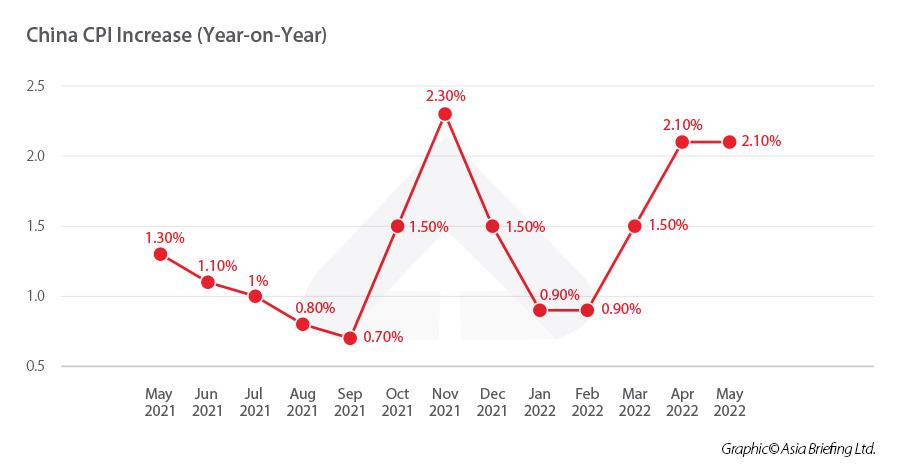

The consumer price index (CPI), a main gauge of inflation, rose 2.1 percent year-on-year (y-o-y) in May, according to data from the National Bureau of Statistics (NBS).

May’s reading is at a six-month high, reflecting rising prices for crude oil, farm produce, and material imports. It is also among the highest statistics in recent months. A Reuters forecast reveals that the CPI is expected to trend upwards over the next few quarters but will likely average at 2.2 percent in 2022, which is relatively mild by regional standards.

On a monthly basis, the CPI edged down 0.2 percent, compared to the 0.4-percent uptick in April. China’s core CPI, which excludes the volatile prices of food and energy, rose by 0.9 percent y-o-y in May – unchanged from April.

The slight drop was primarily due to decreasing prices for food, which fell 1.3 percent month-on-month, reversing the 0.9-percent gain in April. As the market supply increased and logistics steadied, fresh vegetables experienced a 15-percent price drop. The price of pork, a staple meat in China, dropped 21.1 percent, with the stockpiling continuing to replenish state reserves.

Part of the decline in CPI data also relates to the weighting of goods and services that make up China’s CPI basket. Authorities have not disclosed the details of the weighting after changes in 2021. As an upper middle-income country, China gives more weight to food and clothes, estimated by analysts at 18.4 percent and 6.2 percent, respectively. In contrast, developed countries tend to place more emphasis on shelter and transport, both easily affected by global energy prices and domestic monetary conditions. This discrepancy also explains why China’s CPI remains more stable.

PPI on a downward trend

There are two inflationary measures in the Chinese economy, the Consumer Price Index (CPI) and the Producer Price Index (PPI). CPI is a measure of the total value of goods and services that consumers have bought over a specified period, while PPI is a measure of inflation from the perspective of producers.

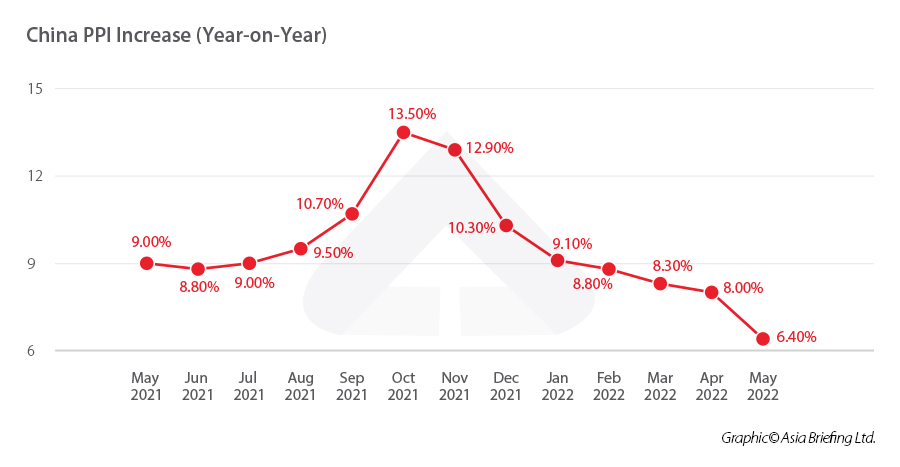

According to the NBS data, the PPI rose 6.4 percent y-o-y, after an 8-percent rise in April. It was the weakest reading since March 2021.

On a monthly basis, China’s PPI gained 0.1 percent, compared with the 0.6-percent increase in April. Both the monthly and y-o-y growth rates of PPI continued to narrow.

RELATED NEWS

Among 40 categories, industries including coal mining, nonferrous metal smelting, petroleum, coal, and other fuel processing as well as chemical raw materials and chemical manufacturing saw a slowdown in price increase.

As more cities lift lockdown measures, China’s economic activities will return to normal and enable the transition to smooth and stable supply chains. Its massive industrial capability means it has more room to deal with the price hikes for global commodities. In May, trade data showed that China’s exports surged 16.9 percent from a year earlier, the fastest growth since January, and well above April’s 3.9 percent rise. Imports rose 4.1 percent from a year ago, the first increase in three months, as demand for raw materials rose and factories restarted production after lockdowns.

Meanwhile, the PPI is likely to continue to trend down also because of a base effect—given increasingly high producer price inflation readings as last year progressed.

On the other hand, China’s continuous push on infrastructure investment could prevent PPI inflation from sliding too fast.

How to understand China’s inflation data?

PPI and CPI usually tend to have a strong correlation – consumer prices would follow suit if prices for production materials rose or fell. In China’s case, however, the correlation has been weakened. Based on the estimation, China’s CPI may remain flat or slightly drop in June while the PPI is likely to continue to downgrade, tightening the gap between consumer and factory-gate prices.

Such inflation statistics are comfortably below the government’s full-year maximum of 3 percent. Viewing it as a factor for social instability, China is always on high alert for inflation and its monetary policy’s primary objective is to stabilize prices and employment.

On the ground, ordinary people’s perception of consumer inflation might be larger than what is revealed in official figures. For instance, the rising petrol price (27.6 percent, 30.1 percent, and 26.9 percent y-o-y increases for gasoline, diesel, and LPG in May, respectively) may direct many families to switch to public transport or electric vehicles.

On the other hand, China’s lower inflation data is partly a result of plunging domestic demand due to COVID-19 controls, which slowed down factory and retail activities. Sensing such a decline, the government has been ramping up stimulus measures to boost domestic market consumption and foreign trade.

The modest inflation pressure gives China bigger room in applying fiscal policies to prop up the economy while most other countries scramble to combat high inflation.

China’s stimulus policy package to reach its economic goals

Though commodity prices remained largely stable, China is alert to imported inflation due to surging global prices for energy and raw materials. The country’s economy has slowed significantly in recent months, hit by strict COVID-19 controls, disrupting supply chains, and jolting production and consumption. Meanwhile, reaching the 5.5 percent growth target has become a key focus for officials.

In late May, China’s State Council announced a package of 33 measures covering fiscal, financial, investment, and industrial policies to revive its pandemic-ravaged economy.

The 33 measures include policies to ensure energy and food security by stabilizing the domestic supply. China also plans to launch a number of new wind, solar, and coal-fired power projects this year and enhance storage for resources like coal and crude oil.

China will also promote the healthy development of platform companies, which are expected to stabilize jobs, maintaining the unemployment rate below the government’s 5.5 percent ceiling. Platform companies are encouraged to make breakthroughs in areas, including cloud computing, artificial intelligence, and blockchain technologies, following signals that authorities are easing the crackdown on e-commerce platforms and tech giants.

In terms of monetary and financial policies, China will boost financing efficiency by supporting domestic firms to list in Hong Kong and promote offshore listings by qualified platform companies. Last month, the Chinese mainland and Hong Kong agreed to connect the Exchange-Traded Fund (ETF) services, as a move to attract more foreign investors and further open up the financial market.

To enhance fiscal support to the economy, China will accelerate local government special bond issuance and cash support for firms that hire college graduates. The State Council also vowed to further reduce real borrowing costs and strengthen financial support for infrastructure and major projects. In an apparent answer to the calls, the Shanghai and Shenzhen stock exchanges published rules to allow listed real estate investment trusts (REITs) to raise fresh money to fund acquisition of infrastructure projects. Authorities will also provide tax credit rebates to more sectors and allow firms in industries hit hard by COVID-19 curbs to defer social security payments, according to the State Council.

These measures will create more opportunities for foreign investment, whose capital brings significant value to the vast Chinese market. China’s continuous efforts to liberalize its market access will also reignite global interest in the country’s economic outlook.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.