By Dezan Shira & Associates

Editors: Ramya Bodupalli and Zhou Qian

China’s value-added tax (VAT) reform is the largest tax overhaul in the country since 1994. The reform began as a Shanghai-based pilot program – a popular method for incubating reforms in the country – in 2012 before expanding to other cities and nationwide to all sectors in 2016.

In short, the reform replaced the Business Tax (BT) – which previously coexisted alongside VAT, and applied to a select number of industries – with the VAT. After VAT reform, authorities treated the sale of goods and services alike, eliminating the disproportionate taxation of services and simplifying China’s tax system

Nevertheless, authorities have continued to amend the reform.

In August 2017, the State Council announced plans to enhance the non-standardized tax rate structure, simplify the tax compliance system, and push forward VAT legislation. Prior to this, in July 2017, China’s State Administration of Taxation (SAT) simplified the VAT system from four to three tiers: VAT rates were simplified to three brackets – six, 11, 17 percent, with the 13 percent bracket removed.

The nature of VAT reform will remain fluid as the authorities continue to simplify and streamline VAT in the country. In the meantime, the demands of the VAT system remain onerous, particularly for foreign investors who are unfamiliar with the tax system in China. In this article, we explain the basics for calculating VAT in China.

Taxpayer categories

Under the VAT, taxpayers fall into one of two categories based on their annual taxable sales amount: general taxpayers or small-scale taxpayers.

Taxpayers with annual taxable sales exceeding the annual sales ceiling set for small-scale taxpayers must apply for general taxpayer status. A company must obtain VAT general taxpayer status in order to issue fapiao, which is a key requirement for conducting business. The sales ceilings are:

- RMB 500,000 (US $75,400) for industrial taxpayers (i.e., enterprises primarily engaged in the manufacture of goods or provision of taxable services);

- RMB 800,000 (US $120,570) for commercial taxpayers (i.e., enterprises engaged in the wholesale or retail of goods) ; and,

- RMB 5 million (US$754,000) for VAT reform taxpayers.

Small-scale taxpayers are subject to a lower three percent uniform VAT rate; general taxpayers are subject to rates ranging from six to 17 percent. However, small-scale taxpayers cannot credit input VAT from output VAT, nor are they entitled to VAT export exemptions and refunds.

Taxpayers who have annual taxable sales below the ceiling, as well as taxpayers who have recently established a new business, can voluntarily apply for general taxpayer recognition, provided they are capable of setting up legitimate, valid, and accurate bookkeeping.

Tax specialists at Dezan Shira & Associates note that local tax authorities may use unwritten requirements to assess the type and number of VAT fapiao available to the taxpayers. These “soft” requirements may include factors such as registered capital, office size, and number of employees.

![]() RELATED: How China’s VAT System Skews Financial Reporting

RELATED: How China’s VAT System Skews Financial Reporting

Calculating VAT

Taxpayers may use two methods for calculating VAT payable: the general calculation method and the simplified calculation method. Generally, the former applies to general taxpayers and the latter applies to small-scale taxpayers.

General calculation method

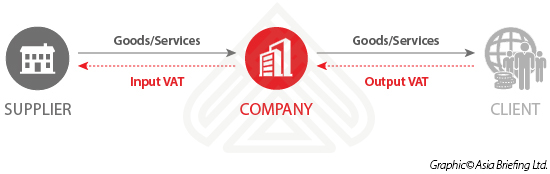

VAT payable under the general calculation method is the current output VAT deducted by the current input VAT:

- VAT payable = Current output VAT – Current input VAT

Output VAT refers to the VAT amount calculated according to the sales volume of the taxable services provided and the applicable VAT rate:

- Output VAT = Sales volume x VAT rate

Sales volume refers to the entire price and other charges obtained by the taxpayer from providing taxable services. Where the taxpayer’s pricing combines sales volume with output VAT, the taxpayer should use the below formula to calculate the sales volume:

- Sales volume = Tax-inclusive sales volume / (1 + VAT rate)

Input VAT refers to the VAT paid, or borne by the taxpayer, when purchasing goods, or receiving processing, repair and replacement services, as well as taxable services. Input VAT that taxpayers can deduct from output VAT includes the VAT amount specified on:

- A special VAT invoice (including goods transportation industry VAT special invoices) obtained from the seller;

- A Customs Import VAT Special Payment Document obtained from Customs; or,

- A tax payment certificate obtained from the tax authority or Chinese agent for taxable services provided by foreign entities or individuals (in this case, the written contract, proof of payment and bill or invoice issued by the foreign entity are also required).

Tax specialists at Dezan Shira & Associates provided the following example: A design company purchases RMB 600 worth of design services from a supplier, and then provides RMB 1,000 worth of design services to a customer. The VAT rate for design services is 6 percent; the VAT payable is RMB1,000 x 6% – RMB600 x 6% = RMB 24.

If the current output VAT amount is less than the current input VAT amount, taxpayers forward the outstanding portion to the next filing period. However, taxpayers should note that certain input VAT items cannot be deducted from output VAT, including non-VAT taxable items, VAT-exempt items, and items that adopt the simplified calculation method.

If a taxpayer provides taxable services that are subject to different rates, the taxpayer should account the sales volume for each tax rate separately or else the highest tax rate will apply.

Where an overseas entity or individual provides taxable services in China and does not have an operating entity in China, the tax withholding party should calculate the amount of tax to be withheld using the below formula:

- Amount of tax to be withheld = Price paid by the service recipient / (1 + VAT rate) x VAT rate

Simplified calculation method

Under the simplified calculation method, no input VAT is deductible and a uniform 3 percent levying rate applies:

- VAT payable = Sales volume x VAT levying rate (3%)

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

Zero-rated VAT and VAT exempt services

The export of taxable services are zero-rated or VAT exempt. Both zero-rated and VAT exempt services are exempt from output VAT.

What is the difference between zero-rated and exempted VAT? Under zero-rated VAT, the input VAT attributable to the export of services can be credited from VAT payable and/or refunded. Under the exemption system, the input VAT attributable to export of services cannot be credited or refunded.

According to relevant regulations, VAT zero-rating takes precedence over VAT exemption when a pilot service is eligible for both VAT zero-rating and VAT exemption. A provider of zero-rated VAT services may opt to pay VAT or apply for VAT exemption instead by filing a relevant declaration; however, these taxpayers cannot elect for a VAT zero-rating in the subsequent 36 months.

Since the procedures for obtaining a tax refund for zero-rated VAT services are complex, taxpayers who have little input VAT deductible often opt for VAT exemption.

Zero-rated VAT calculation methods and treatments

For zero-rated VAT services, the exemption, credit and refund method applies to the provision of zero-rated services by taxpayers who adopt the general calculation method, while the exemption and refund method applies to foreign trade enterprises that provide both zero-rated and other services. These methods are as follows:

- The exemption, credit and refund method: VAT is exempted, and the corresponding amount of input VAT is used to offset the amount of VAT payable – any surplus is refunded.

- The exemption and refund method: VAT is exempted, and the corresponding input VAT on purchased taxable services is refunded.

Special VAT invoice cannot be issued for zero-rated services. Providers of zero-rated taxable services should submit the following materials in order to qualify for the treatment:

- An application form for recognition of export tax refund (exemption) eligibility and electronic data generated by the export tax refund (exemption) reporting system;

- The relevant business licenses and permits for international transportation services;

- The time charter and wet lease for international transportation services as well as the relevant contract or agreement for lessees leasing transportation tools via voyage charter;

- The Technology Export Contract Registration Certificate for R&D and design services;

- The certification qualification, the Foreign Trade Operator Filing Registration Form, and the PRC Customs Goods Import and Export Consignor Consignee Customs Registration Certificate for zero-rated VAT services providers that engage in export of goods but have not undergone export tax refund (exemption).

Following the recognition of the sales revenue from the provision of zero-rated VAT services, the service providers should file VAT returns and apply for refunds with the tax authority within the VAT filing period in the subsequent month (or quarter).

The service provider should collect all relevant certificates and apply for a refund between the subsequent month (or quarter) following revenue recognition and April 30 of the following year, or they will no longer be entitled to obtain the refund (exemption).

Among other materials, international transportation service providers should provide original copies of the cargo, passenger manifests, or other vouchers reflecting the service revenue. R&D and design service providers should provide the relevant Technology Export Contract Registration Certificate and R&D or design agreement signed with the overseas entity.

Obtaining VAT exemption

To obtain exemption for exported services, a written cross-border service contract must be signed with the service recipient. In addition, the entire income from the service must be obtained from overseas. Companies that utilize intercompany arrangements should note that no exemption can be applied if a local branch or company pays for the service.

Taxpayers providing VAT exempt exported services should conduct separate accounting for the sales volume of the exported services and calculate non-deductible input VAT. No special VAT invoice should be issued for VAT-exempt income.

To apply for exemption, taxpayers should conduct filing with the tax authority and submit materials, including the service agreement (translated into Chinese from any foreign language), proof that the service took place overseas, proof that the service recipient is located overseas, and any proof that the transport involves foreign destinations.

Editor’s note: This article was originally published on December 19, 2013; the article has been reviewed, revised, and updated to reflect the latest developments.