Shanghai, Guangdong, and Inner Mongolia are piloting fully digitalized invoicing – a more advanced version of the system of e-invoicing in China. After undergoing real-name verification, taxpayers under the pilot program can obtain, issue, and verify electronic invoices through the national e-invoicing service platform, which can also be used for bookkeeping. Taxpayers will be free from getting the special tax control equipment, verifying the invoice type, and applying for obtaining the invoice. This has been the latest move by the Chinese government to upgrade the digital infrastructure and bureaucratic process of tax collection and administration.

On November 31, 2021, tax authorities from Shanghai, Guangdong, and Inner Mongolia released respective announcements to implement pilot programs of fully digitalized invoicing (also known as e-fapiao in China) among selected taxpayers in Shanghai, Guangzhou, Foshan, Guangdong-Macao Intensive Cooperation Zone, and Hohhot from December 1, 2021.

How are the ‘fully digitized’ e-fapiao different from other types of e-invoices in China?

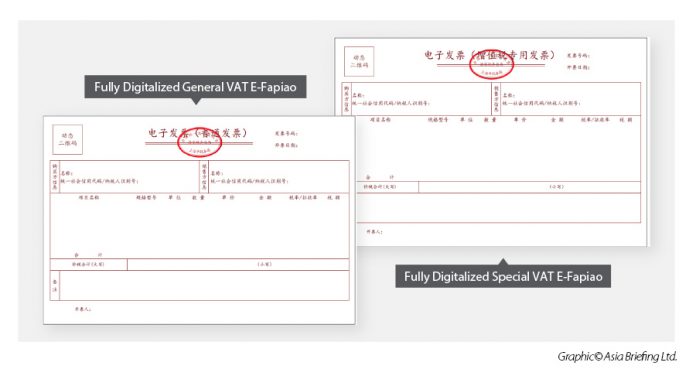

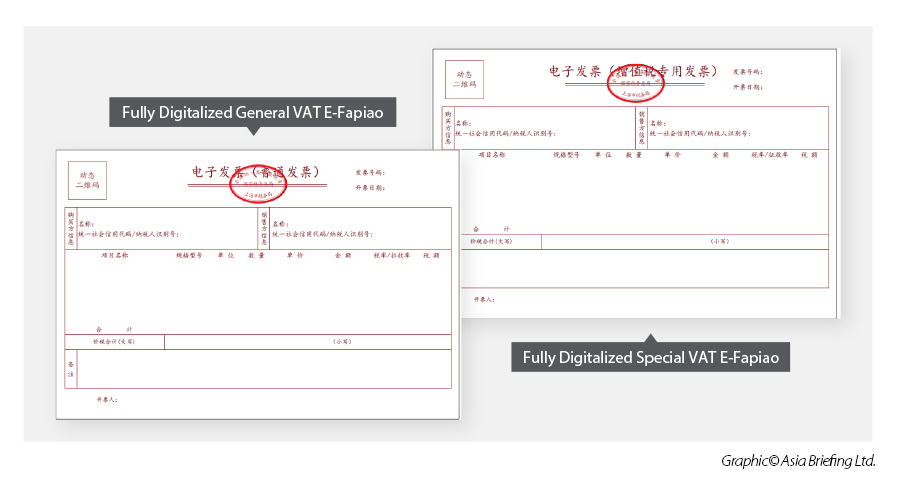

The fully digitalized e-fapiao is a completely new type of electronic invoice, different from the normal value-added tax (VAT) e-fapiao introduced last year and the paper fapiao. The fully digitalized e-fapiao consists of two sub-types: fully digitalized special VAT e-fapiao and fully digitalized general VAT e-fapiao.

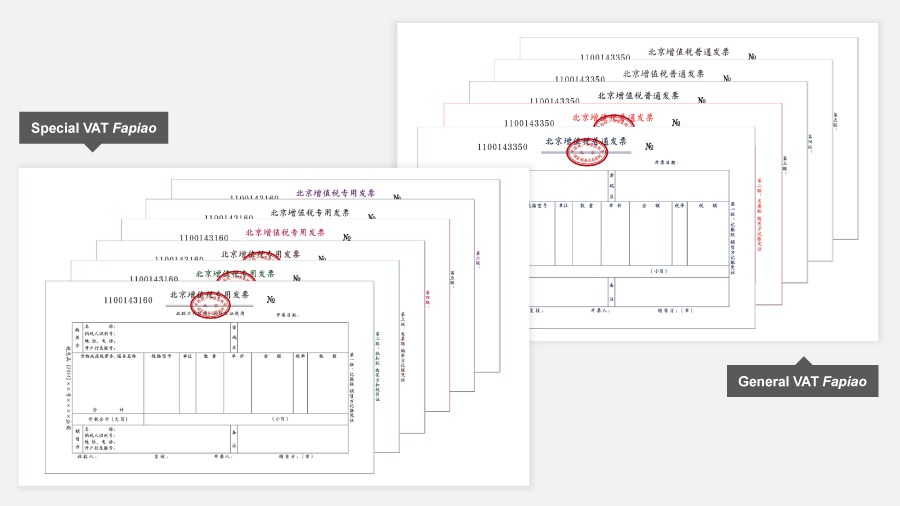

With their introduction, there will be a total of six kinds of fapiao co-existing in China during the country’s ongoing fapiao system reforms. The six types are special VAT fapiao, general VAT fapiao, special VAT e-fapiao, general VAT e-fapiao, fully digitalized special VAT e-fapiao, and fully digitalized general VAT e-fapiao.

In the fully digitalized e-fapiao programs, a national unified e-invoicing service platform will provide pilot taxpayers 24-hour online services to issue, deliver, and verify fully digitalized e-fapiao free of charge. This means the special tax control equipment, such as golden tax USB disk, tax control USB disk, and tax UKey, is no longer needed.

Following the introduction of the normal value-added tax (VAT) e-fapiao and the construction of the Golden Tax System Phase IV, the fully digitalized e-fapiao marks the latest effort by the Chinese government to promote the digital upgradation and intelligent transformation of tax collection and administration and reduce the cost of tax management.

What are the key features of the fully digitalized e-fapiao?

The fully digitalized e-fapiao has the same legal effect and usage as the existing paper fapiao but has no sheets. Like other VAT electronic fapiao, it has no invoice copies (normal paper fapiao consists of the stub copy, the deduction copy, and the account-keeping copy for the fapiao issuers and receivers to keep and use).

- HAVE A QUESTION ABOUT APPLYING FOR CHINA IIT SUBSIDIES? ASK OUR PAYROLL EXPERTS ON THE GROUND

The fully digitalized e-fapiao will also look neater, with only 17 items of content: dynamic QR code, invoice number, issuance date, buyer information, seller information, project name, specification and model, unit, quantity, unit price, amount, tax rate/levy rate, tax amount, total, ad valorem and tax total (in words and figures), remarks, and invoice issuer.

The samples of the fully digitalized electronic fapiao can be found below:

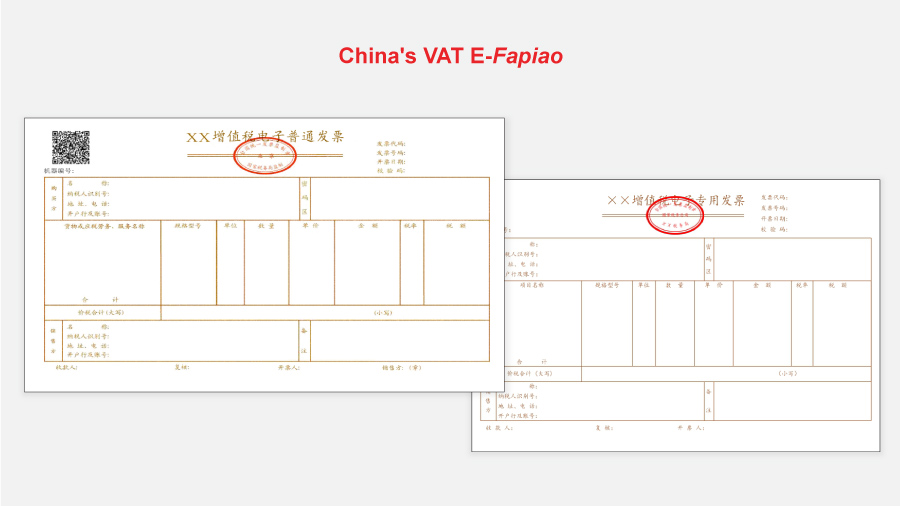

In comparison, the normal VAT electronic fapiao and conventional fapiao looks more complicated as below:

As a brand new electronic invoice variety, fully digitalized e-fapiao will have new features as explained below.

Simplifying procedures to obtain and issue fully digitalized e-fapiao

- “No medium”: Taxpayers under the pilot program will not need to get the special tax control equipment (the medium) in advance to issue fapiao; Instead, they can issue the fully digitalized e-fapiao through the national e-invoicing service platform.

- “Fapiao number automatic assignment system”: Taxpayers under the pilot program will not need to obtain the fapiao through application to the tax bureaus; Instead, they can obtain the fully digitalized e-fapiao through the e-invoicing service platform, which will automatically assign a unique fapiao number when the fapiao information is generated.

- “Managing the total amount of fapiao based on taxpayers’ credibility”: The tax authorities will determine the initial total amount of invoices issued by the taxpayer in a calendar month and make dynamic adjustments thereto – based on the risk level, taxpaying credit rating, actual operating conditions, and other factors of a taxpayer.

Eventually, newly established taxpayers can issue a fully digitalized e-fapiao as soon as they start the business and there will be no conventional ‘prepositive procedures.’

More convenient ways to issue, deliver, and verify fapiao

- Diversified channels to issue fapiao: Pilot taxpayers can issue the fully digitalized e-fapiao through the unified e-invoicing service platform. In the future, they may be able to issue such e-fapiao through a terminal or the mobile app. This way they will no longer require special tax control equipment.

- One-stop e-invoicing service platform: After logging onto the platform, pilot taxpayers can issue, deliver, and verify fapiao on the single one platform, instead of completing related operations on multiple platforms as before.

- More widely applicable fapiao data: Pilot taxpayers’ tax digital accounts on the e-invoicing service platform will automatically collect invoice data for inquiry, downloading, and printing by pilot taxpayers.

Once the fully digitalized e-fapiao is issued, the fapiao information will automatically be sent to the tax digital accounts of both the issuer and the receiver for them to check and download. The issuers can track the invoice usage of the receiver in real time through the tax digital account (such as whether the fapiao has been ticked or not).

These digitalized fapiao data will also lay a foundation for taxpayers to pre-fill the ‘one integrated form’ for tax declaration. - No specific digital formats required: Unlike normal VAT e-fapiao, which has to be in PDF or OFD formats, fully digitalized e-fapiao is not required to be saved in a specific digital format. Pilot taxpayers can deliver fully digitalized e-fapiao through their tax digital accounts on the e-invoicing service platform, or deliver fully digitalized e-fapiao by email, QR code, or other means. This will reduce fapiao delivery costs and make it easier for taxpayers to process fapiao.

- Unblocked channel to access tax services: The e-invoicing service platform will incorporate more interactive features, such as smart consulting and objection submission functions.

In addition to the above, in the future, the e-invoicing service platform is expected to support the direct connection with ERP and other financial software of the majority of enterprises to realize the integrated operation of invoice reimbursement, entry, and filing.

Preparing for the fully digitalized e-fapiao

Fully digitalized e-fapiao will bring new opportunities and challenges to corporate fiscal and tax management. It is expected to greatly reduce the workload of enterprises’ financial and accounting staff and increase the efficiency of issuing a fapiao. However, businesses should also be alert to possible tax risks and compliance risks.

Businesses are advised to keep track of the promotion process of fully digitalized e-fapiao, upgrade their enterprise ERP system and fapiao management system, and optimize the fapiao management process and the internal digitalized reimbursement process. It is important to get prepared and develop a thorough strategy for e–fapiao to alleviate operational risks and get the most out of the e-invoicing system.

This article was first published by China Briefing, which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in China, Hong Kong, Vietnam, Singapore, India, and Russia. Readers may write info@dezshira.com for more support.